Trying borrow half a million from family in case I don’t get a loan

I waived all the contingencies. Don’t do that. As a real estate agent, I was able to represent myself in the purchase…

I waived all the contingencies. Don’t do that.

As a real estate agent, I was able to represent myself in the purchase of my house and I did not know what I was doing. It could have ended up very badly.

I had represented my sister and a good friend with their home purchase and I followed best practices and told them they should not waive inspection or mortgage contingency. But I did not follow my own advice.

I did get a home inspector (Richie Wong) to walk through the house with me before I put in an offer. He didn’t see any major issues and the foundation was really good and I thought I was all set. I was wrong.

I was proud of myself for getting my offer accepted. My offer was over asking by 70K, waived home inspection contingency AND the mortgage contingency AND a fast closing in less than 30 days. It’s like feeling proud of yourself after getting a job where you’re offering 3 months of free work. The other party is getting the deal. Not you.

A house a couple blocks from this one had sold for 850K. It was as dark as a dungeon when you walk in during the middle of the day, the exterior siding was flaking off, you could not stand up in the basement, and it was so cramp I knocked over the cat’s water bowl trying to walk dodge the kitchen table. I used the 850K dump as the main comparison metric. I felt that I was getting a deal if I got my house for 866K. In all fairness I probably it’s probably still not a bad purchase but waiving everything was NOT good.

I still remember the series of events because it was traumatic. The appraiser came back with the value of the house and it appraised. Luckily it was worth 866K. BUT, he deemed the house unlivable. Which means that the bank cannot give use the conventional loan we initially negotiated for. My heart skipped a beat when the loan officer told me that I can’t have the loan. I kept him on the phone for an hour talking through my options and he promised me to look into what loan products were available.

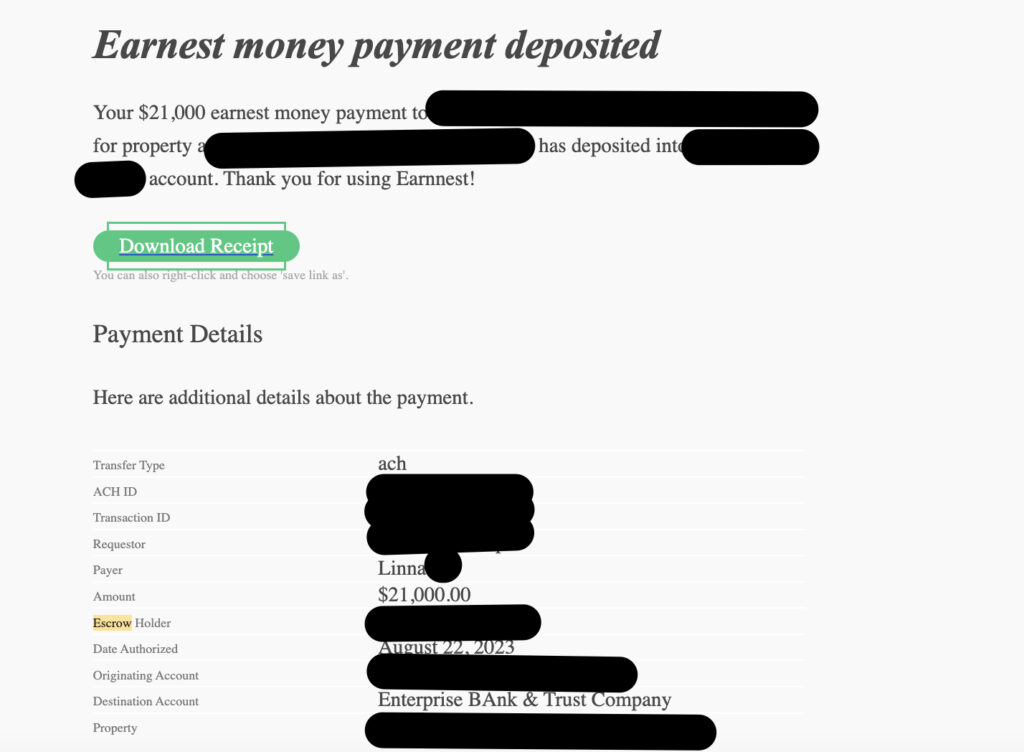

After the call I was freaking out. My friend and I have each paid for half of the deposit, totaling 45K. If didn’t get the loan we’d have to come up with the money ourselves or lose the deposit.

Somehow it didn’t occur to me that the house could be deemed unlivable even though the ceiling of one of the bathrooms had significant water damage to the point that the wood looked like it was rotting. There were also holes in multiple walls. If I a home contingency I would have been able to get a home inspection that would have pointed out all the issues. Or if I had a mortgage contingency I could walk away from the purchase in this situation.

Over the next couple days I called all the family members I knew to ask if I could borrow money. Somehow I was able to raise some money which gave provided a back up plan. Luckily the bank came back and said they could give me a portfolio loan but with a 7 percent interest instead of the original 6 percent. This was unfortunate but better than no loan at all.

This was one of many hiccups along the way. I had moved some money across my bank accounts and they wanted letters from all the people the money came from because it hasn’t been in my bank account for more than 90 days. When you’re getting a mortgage, make sure the you’re paying through just ONE bank account and that the money in that bank account is enough funds for to pay closing costs and the down payment.

The bank did end up lending me the money and I was able to close on time but I had to call the bank every single day to check in and make sure my loan was top of mind. I really think that if I hadn’t been a pain in their neck I would not have made it in time for the closing date. I really had to push them to get things moving because they didn’t tell me that I was missing documents unless I called and asked.

Lesson learned here is that even if you really really really want the house, make sure you have the mortgage contingency.